🔍 Core Strategy Highlights (Pre-Market Fibonacci Hack)

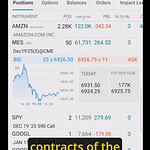

Auto Fibonacci Pre-Market Levels:

Before the market even opens, we anchor Fibonacci levels to the overnight high and low. This gives us institutional levels that algos respect during the entire trading session.

Pre-Market Reaction Zones:

We’re watching how price behaves at the 78.6%, 61.8%, and 50% retracements before the bell rings and during regular trading hours. These reactions show where buyers or sellers already positioned themselves.

Break + Retest Setup:

Once the market opens, the cleanest trades come from:

Price breaking a key pre-market Fib level

Retesting it

Entering in the direction of the reaction

This avoids FOMO and forces patience.

📈 Why This Pre-Market Hack Works

Institutional Anchoring:

Funds, market makers, and HFTs all can use overnight liquidity zones.

Pre-market highs/lows are psychological magnets for the first 30–60 minutes of the session.

Predictive Behavior:

The overnight range tells you where the money is sitting and where stop clusters are hiding.

Fibonacci levels simply map the pressure points.

Cleaner Trades:

Most traders lose money in the chop right after market open.

When you anchor to pre-market Fibs, you instantly know:

Where to avoid

Where to strike

Where reversals are likely

Where breakouts turn into traps

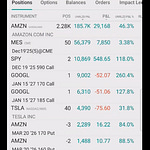

🎯 Risk/Reward (The Real Edge)

This method is asymmetrical.

The risk is tiny because you’re trading off a defined Fib zone.

The reward is large because morning volatility expands quickly from pre-market levels.

This gives you:

High win probability

Tight invalidation

Low stress trading

Fast compounding

Zero need for complicated systems

This is how traders scale small accounts responsibly. Remember with a 2:1 Risk Reward ratio you only need to win 4 in every 10 trades to profit!

🔗 Want the Tools?

Auto-Fibonacci Indicator Library: Lifetime access here

🚀Join My Discord Here: TradingWarz Discord