In this short video, I break down the exact Fibonacci investing framework I’ve used to grow my account past $1,000,000 — without prediction, hype, or overtrading.

This is not day-trading noise.

This is how I use Fibonacci to buy dips on strong assets and stack probability in my favor.

🔍 Core Strategy Highlights

📐 Fibonacci Anchor (The Foundation)

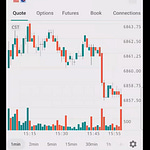

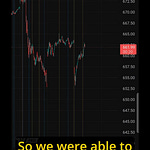

I anchor Fibonacci from major swing highs to swing lows on higher timeframes.

The key decision zones are:

50%

61.8%

78.6%

These levels are where institutions step in, not where retail chases.

🕰 Higher-Timeframe Bias First

This strategy starts on MONTHLY CHARTS, not the 5-minute.

I’m identifying:

Trend direction

Where smart money is likely accumulating

Where risk can be clearly defined

No guessing. No indicators overload.

🎯 Precision Entries, Defined Risk

Once price reaches a Fibonacci zone:

I wait for confirmation (hold, reclaim, or strong reaction)

Risk is kept tight and predefined

Position sizing is conservative

This allows me to stay in trades longer and avoid emotional exits.

🧠 Simple > Complicated

There’s no need for:

❌ 10 indicators

❌ prediction models

❌ constant screen-watching

Just:

✔️ Clean Fibonacci levels

✔️ Price reaction

✔️ Patience

📈 Why This Works

🧲 Liquidity Lives at Fibonacci Levels

Institutions don’t buy tops — they scale into retracements.

Fibonacci zones naturally align with:

VWAP

Moving averages

Prior structure

Options positioning

That’s where the edge comes from. THINK like an INSTITUTION and get DEEP Discounts on GREAT Companies.

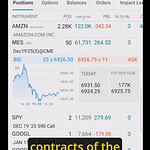

📊 Asymmetry Is the Real Edge

Small risk + large potential upside = compounding.

You don’t need a high win rate — you need structured trades.

This is how long-term investors and professionals survive volatility.

🔗 Want the Tools?

Auto-Fibonacci Indicator Library: Lifetime access here

🚀Join My Discord Here: TradingWarz Discord

LIFETIME DISCORD GIVEAWAY

How to Enter

1. Simply CLICK all 3 of my official guides! I partnered with IBKR to bring you NO CHARGE Education

👉 IBKR FREE Traders Academy:

👉 I trade options with Options Wizard:

👉 How I use Margin with Futures Trading:

2. After you’ve done that, drop a LIKE on this Substack post to complete your entry.

Past Winner: Cxpy Next Winner will be announced this week.